What Is Equity—and How Can Idaho Homeowners Use It to Build Wealth?

Understanding Equity in Real Estate

Equity isn’t just a financial buzzword—it’s one of the most powerful tools homeowners and investors can use to build long-term wealth. Whether you own a rental in Boise or a home in Idaho Falls, understanding how equity works can help you make smarter decisions, grow your portfolio, and access cash when it counts.

In this post, we’ll break down what equity is, how it builds over time, and how Idaho property owners can use it to their advantage.

What Is Equity?

At its core, equity is the difference between your property’s market value and what you owe on it.

Simple Example:

If your home in Meridian is worth $400,000 and your mortgage balance is $300,000, you have $100,000 in equity.

This equity is your financial stake in the property. The more equity you have, the more options you have—whether you want to reinvest, refinance, or build long-term security.

How Does Equity Grow in Idaho?

There are three main ways equity increases over time:

1. Market Appreciation

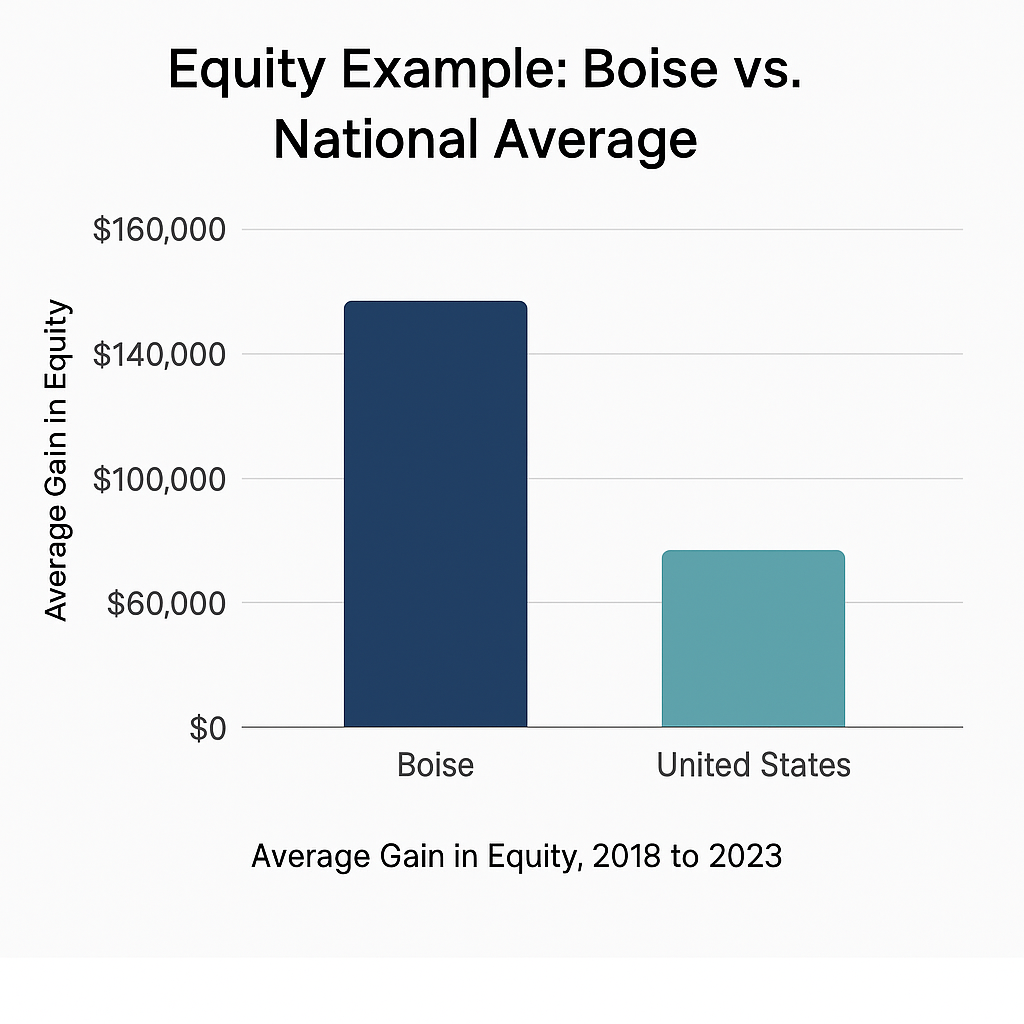

Idaho’s real estate market—especially in places like Boise, Eagle, and Idaho Falls—has seen strong appreciation over the past decade.

🏷️ In 2023 alone, Boise home values increased by over 7%.

When the market rises, so does your property’s value—boosting your equity without you lifting a finger.

2. Paying Down Your Mortgage

Each monthly payment reduces your loan balance and increases your ownership stake. Want to accelerate it? Even one extra payment per year can shave years off your loan.

3. Smart Renovations

Strategic upgrades—such as energy-efficient windows, new roofs, or kitchen remodels—can directly increase your property value.

📥 Want our renovation ROI guide? Visit our post on Why Renovation ROI Matters.

How Idaho Homeowners Can Use Their Equity

Once you've built equity, you can tap into it in several powerful ways:

1. Home Equity Line of Credit (HELOC)

Like a credit card backed by your home’s value. Use it for renovations, emergencies, or investment opportunities.

🏷️ Example: One of our Meridian clients used a HELOC to install solar panels—lowering long-term utility costs and increasing resale value.

2. Cash-Out Refinance

Refinance your mortgage and pull out some of your equity as cash. It’s a great option if interest rates are favorable.

🏷️ One owner in Boise refinanced and used the equity to purchase a second rental property.

3. Sell and Reinvest

If you’re ready to move on, selling a property and using the gains toward a new investment (or leveraging a 1031 exchange) can help you scale up.

4. Partner with Others

Equity gives you a seat at the table. Use it as collateral in an investment partnership or to secure better lending terms.

Tips for Building and Protecting Equity

• Get a free home value estimate yearly. Your Apex team can help.

•

Round up your payments. Even $100 extra each month can make a big impact.

•

Renovate with intention. Not all upgrades increase value.

•

Avoid over-leveraging. Borrow against equity wisely, especially in a shifting market.

Final Thoughts: Equity Is Your Leverage

At Apex Property Management, we see equity as more than a number—it’s a strategic asset. Whether you’re a homeowner or investor, tapping into your equity wisely can help you build generational wealth.

Curious about your equity position or how to use it strategically?

📅

Schedule a free consultation with our team →